Domestic money transfer applications make it incredibly easy to transfer money – and users have come to expect this same level of service for international transfers as well. MoneyGram needed to quickly adapt and grow their business to accommodate changing user expectations and capitalize on an unmet market.

MoneyGram International is the second largest provider of money transfers in the world with locations in more than 200 countries and territories. MoneyGram has experienced 106% digital transaction growth already this year with 48% higher customer retention rates and 34% higher average transactions per month compared to the retail walk-in business.

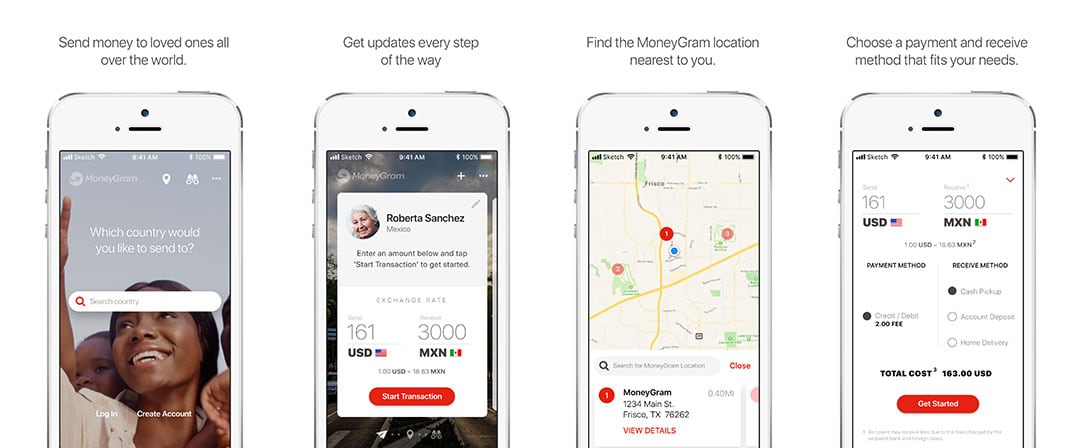

With the rise of easy to use peer-to-peer cash transfer applications like Venmo and Cash App, users’ expectations for money transfers are changing rapidly. Users expect transfers to be simple to initiate and quick to resolve, ideally with money appearing almost instantly. The problem? Most money transfer applications are designed for national transfers, not international transfers. Cash transfers, especially when moving from one currency to another, are much more difficult to navigate and are subject to differing regulations.

In addition to the challenges present in the app, the distributed nature of the money transfer business meant that MoneyGram was also managing 45 country specific websites, constantly educating, showcasing and explaining the value of MoneyGram’s unique features in a “local” voice. Driving the conversion of loyal web-based patrons to a more convenient and frictionless mobile channel was also a difficult challenge, but the inherent benefits to the end user were well worth the effort.