Published by

Exploring the intersection of cryptocurrencies, decentralized applications, and loyalty programs

With over 100 million people now owning Bitcoin and growing, the time is now for brands to consider whether their audience finds value in these spaces and if it’s a lever they should be pulling on to drive future growth. One interesting avenue is the potential intersections of cryptocurrencies and decentralized applications, alongside loyalty programs that customers use and love today. Loyalty programs today are often plagued by “the sea of sameness,” with very little differentiation from one brand’s program to the next. However, we know that web and mobile loyalty customers are often more valuable to a brand by almost any measure, from higher conversion rates to higher average check sizes. Brands must find creative ways to make loyalty programs break through the noise and standout from the competition.

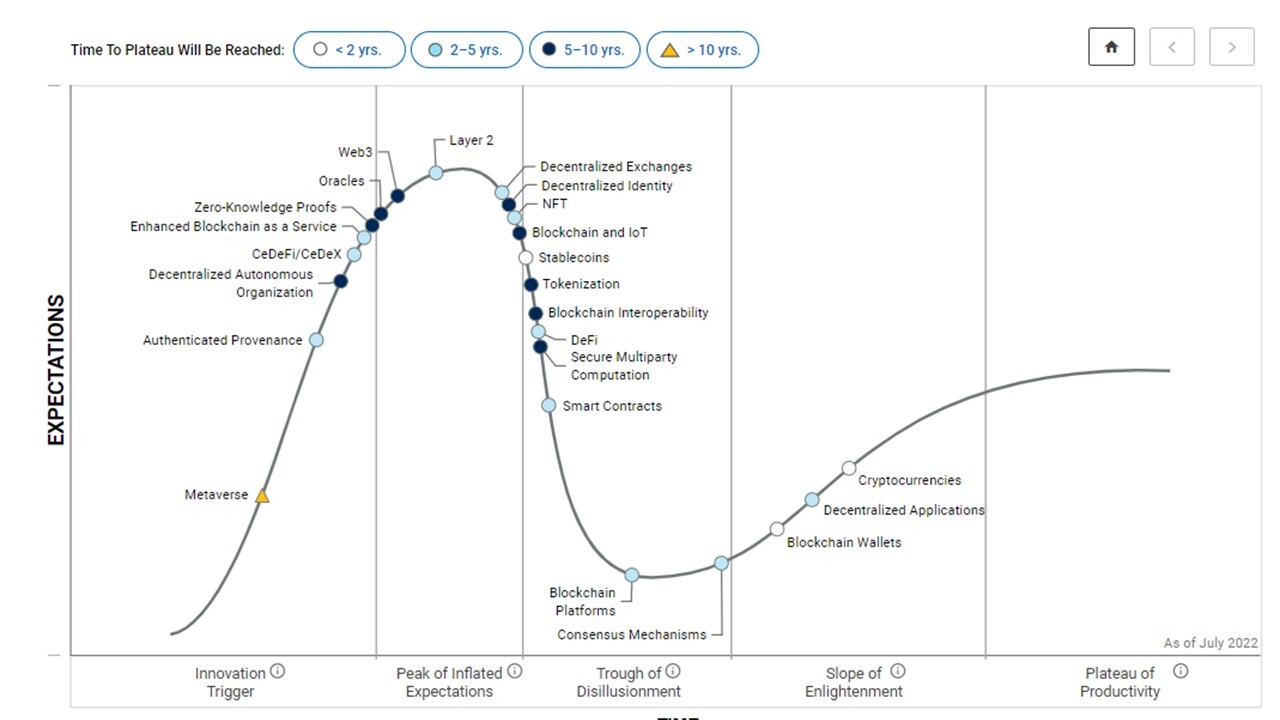

This drive for differentiation and the maturing ecosystem of cryptocurrencies and decentralized applications presents marketers with a unique growth lever to consider when thinking of ways to get more people using their program more frequently. If you look at Gartner’s most recently updated Hype Cycle for Blockchain 2022, you will see that both cryptocurrencies and decentralized applications are within the slope of enlightenment phase, the benefit these technologies can provide to an enterprise are starting to crystalize and become more widely understood. This is the space when enterprise companies start to fund pilot programs, while conservative companies remain cautiously waiting (1).

Each brands journey into this space will be different. Running small, targeted pilots can provide a low-risk way to test ideas out that will make the future path easier to approach. It is recommended that brands start their journey with a healthy dose of user research. These studies might show that the audience does not currently value cryptocurrencies or decentralized applications, which can save businesses a lot of time and money building solutions their customers (or future customers) will never use. If you are a business whose customer demographic skews heavily to the >50 range, it wouldn’t be surprising to get results from the user research study that shows this audience does not currently see value in these areas. On the other hand, if the current or future audience skews <35 years, it wouldn’t be surprising to get the opposite results from the study. Let’s explore a few use-cases that come to mind when thinking about pilot programs to run for those looking to try something out after research indicates customers would be interested in using them.

Offering Crypto Instead of (or in addition to) Typical Rewards Points

As it stands today, most loyalty programs allow participants to earn points which can then be used to redeem something from the brand who distributed them, such as a discount or free item. These points typically cannot be used anywhere outside of the perks offered by each brand. Many customers never end up earning enough points to redeem anything and the rewards can often seem small for how much effort it took to rack up the point to begin with. Giving customers cryptocurrency, such as Bitcoin, turns the table on this dynamic.

Shake Shack started this type of pilot back in March of 2022 where qualifying orders receive 15% of the cost of their order back in Bitcoin. To be eligible, customers must pay with a Cash Card, Cash Apps debit card which is who the promo is in partnership with. The promo lasts through mid-March and is a push to reach younger customers and see if there is enough demand to support paying with crypto brand-wide (3). This small, first-mover pilot program not only limits Shake Shack’s risk, but it also earned them lots of free earned media by the likes of WSJ and CNBC.

NFTs to Note Membership and that Provide Special Rewards

It’s still common for places like grocery stores to hand out physical loyalty cards, but typically the ownership of an account is either by entering a phone number or being signed-in to a brands app for example. NFT’s offer brands a new way for them to offer something unique in the form a digital asset and it allows them to give customers special access to further rewards down the road. The NFT is held in a loyalty customers cryptocurrency wallet and can also be used to interact with a decentralized application if the brand chooses to further explore the blockchain space.

Starbucks has plans to launch this kind of pilot later this year and will distribute a collection of branded NFTs that give loyalty members who receive them unique benefits. The details with regards to what the NFTs will looks like or what rewards could be tied to them are still yet to be shared (4). It would be very innovative if Starbucks launched a decentralized application microsite that gave NFT holders a unique digital experience to engage with using a Metamask wallet or something similar.

DAO’s to Let Customer Have a Vote

Loyalty programs don’t normally give participants a vote in how the program functions or what rewards are offered. With a DAO throw in the mix, this dynamic would change based upon how the brand sets up the DAO. DAO’s are Decentralized Autonomous Organizations where functions of an organization are governed by votes between participants or a collective few chosen to represent various groups of people. Think about a scenario where planning for what people get to redeem for points next year included a vote from customers. This is what a DOA would enable in the context of a brands loyalty program.

We haven’t seen any good pilots announced yet in the enterprise space and you might be wondering why a brand would choose to give any form of control of their loyalty program to their customers. A recent use research study pointed out in an article from Adage (5) found the majority of Gen-Z and millennial consumers (63%) want more influence over how brands make their decisions and would be interested in voting on aspects to channel this influence. As competition heats up for Gen-Z and millennial consumers, you may see groups dip their toe into this pool in exchange for their brand loyalty.

In summary, cryptocurrencies and decentralized applications are reaching the stage of maturity for enterprise brands to begin piloting use cases that incorporate this technology which can be structured around the brands existing loyalty program. We recommend running user research studies on the current or future target customer base to confirm it would be met with interest followed by small, targeted pilots to figure out the best solution that will resonate with them. Iterating on learnings from these pilots can be a way for CMO’s to introduce innovative solutions that serve as the fuel to drive future customer growth.

Sources:

- https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

- https://blogs.gartner.com/avivah-litan/2022/07/22/gartner-hype-cycle-for-blockchain-and-web3-2022/

- https://www.wsj.com/articles/shake-shack-tests-bitcoin-rewards-to-lure-younger-consumers-11646349158

- https://www.theverge.com/2022/5/4/23057221/starbucks-nft-loyalty-program-rewards-perks

- https://adage.com/article/digital-marketing-ad-tech-news/daos-and-gen-z-marketing-strategies-brand-loyalty-using-web3-and-crypto/2423246