Published by

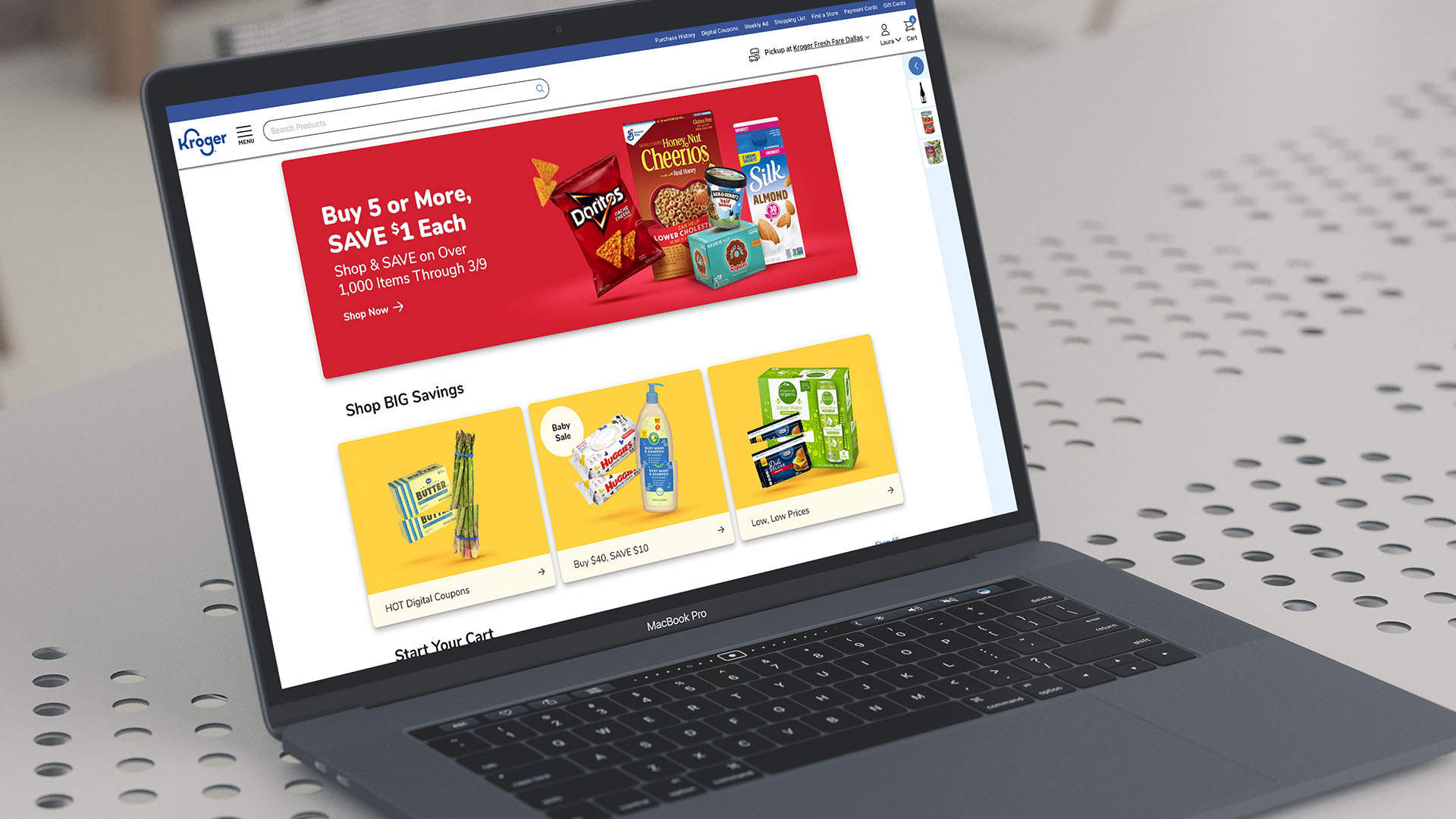

No industry has remained untouched by the digital transformation induced by lockdown restrictions, with the grocery market, in particular, witnessing an accelerated online shift. Grocers are in a prime position to capitalize on the changes in purchasing behavior, as Americans dine out less and cook more meals at home — experiencing a 10% rise in revenue last year as a result. More than a fifth (23%) of U.S. consumers are ordering more groceries online for home delivery now than they did prior to the COVID-19 pandemic.

The sector, however, could experience a downfall as quick as its rise if a vaccine becomes readily available and consumers swarm back to restaurants. Consulting firm Bain & Co. suggests revenue rates may shrink to 2-5% this year — or could even drop by as much as 7%. It’s costly to fulfill e-commerce orders, and the loss of in-store impulse buying could be one of the most damaging effects to profit margins.

How well grocers cultivate customer loyalty with creative digital strategies will determine their market positioning in the unpredictable year ahead. To build a robust customer experience strategy, three components are taking center stage.

Mobile Ordering

There is an ongoing race in the retail food industry for companies to implement innovative technologies to bolster the customer experience. Inmar Intelligence found 68% of shoppers use a grocers’ mobile app while shopping, with 71% interested in using it to help locate desired items within the store, and 78% to find deals and promotions. The rise in the adoption of mobile platforms in the sector presents brands opportunities to introduce greater variety into the digital store whilst boosting customer engagement without a huge marketing budget.

This can include sending push notifications to customers that particular goods are back in stock or suggesting complementary items and recipe videos based on purchase history, and building household profiles so essentials don’t get missed from shopping lists. These data-driven experiences prompt the shopper to make an order; it elevates the mobile ordering experience by offering features that can’t be replicated in-store.

Efficient Delivery

Convenient delivery experiences have reigned supreme since the onset of the crisis, with 43% of U.S. internet users trying curbside pick-up for the first time last year. Scheduled pick-up services have made consumers’ lives both easier and safer amidst the chaos, offering hesitant shoppers — not wanting to pay hefty delivery fees — a middle ground.

To keep up with the surge in demand, grocers will need to do more to resolve kinks and speed up their online delivery services. Brands are adopting innovative solutions to handle the last-mile, reimagine distribution and optimize inventory management, but customers also want to feel reassured that they won’t need to wait at home for their delivery. Some may also struggle with organizing a home delivery for the first time. Instacart offers a great example of how the process can be streamlined and how users’ efforts can be minimized. Customers can now choose a ‘Fast & Flexible’ option, using intelligent technology to match customer orders with real-time shopper availability and deliver orders faster. There’s no need for users to check back for updated delivery slots, instead they can “set it and forget it” and receive a notification when goods are scheduled to arrive, making life that bit easier for shoppers.

Data-Driven Moments

With shoppers buying more goods online, but less frequently, grocers should use purchase history and preference data to make tailored product suggestions, to boost cart size. By tapping into data analytics, brands can deliver highly-targeted marketing campaigns across channels, and aim to drive more regular purchases and better profit margins in the long-run. Masses of purchase data can inform intelligent, geo-based push notifications and encourage more impulse buys.

Brands should be aiming to continuously create value-add experiences by promoting relevant offerings, seasonal re-stocks of rotational items, or even meal bundles to make the customer feel like they’re not just a regular customer. Retailers will witness increased frequency, and value, of purchase if they can keep connected with customers — especially without requiring them to open the app.

Competition amongst grocery brands is increasing as retailers invest in digital strategies to enhance discoverability and lock in customer loyalty. With consumer behavior radically evolving, companies are turning to data-driven tools and applications to create new levels of convenience for customers while recreating the fun aspects of in-store shopping. Finding new, inventive ways to make the shopper’s life easier will help safeguard brands against wavering demand once restaurants reopen their doors.

This article was originally published on SupplyChainBrain.com